The Heartbeat of E-commerce: Understanding Credit Card Payment Processors

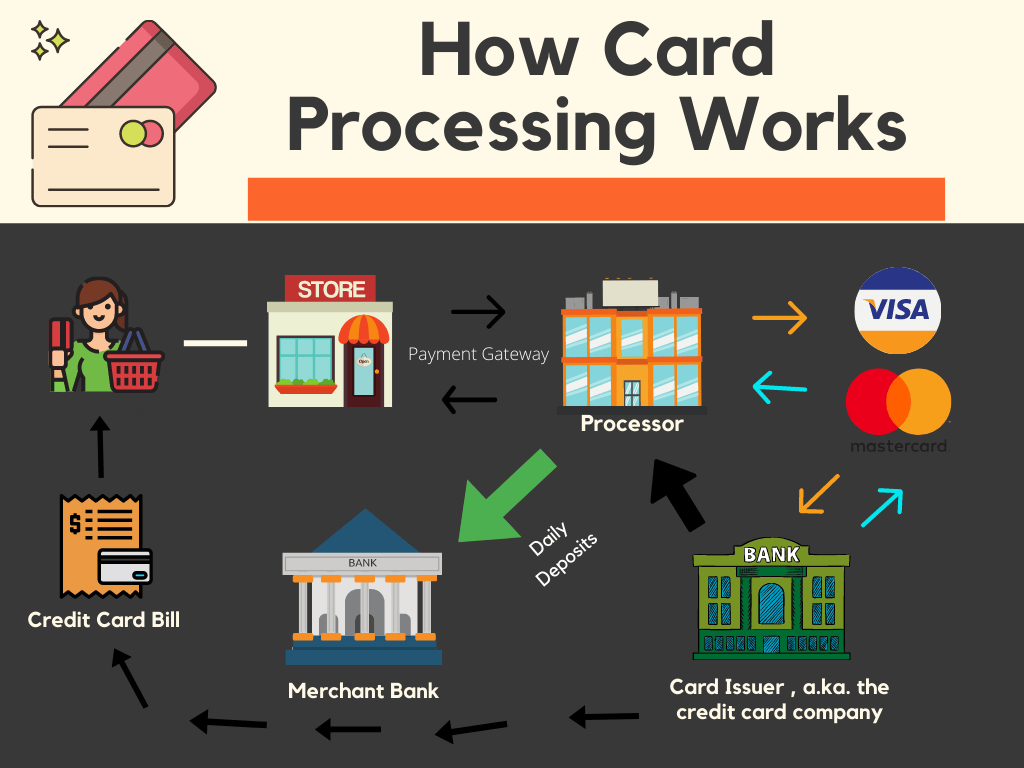

A credit card cost model plays a vital position in the current financial landscape, offering as the linchpin that facilitates electric transactions between merchants and customers. These processors become intermediaries, joining organizations with the banking system and enabling the easy transfer of funds. The quality of the function lies in translating the information from a charge card transaction right into a language understandable by economic institutions, ensuring that payments are authorized, prepared, and settled efficiently.

Among the primary features of a charge card cost processor would be to improve the effectiveness of transactions. When a client swipes, inserts, or shoes their bank card, the payment model easily assesses the deal details, communicates with the appropriate financial institutions, and validates whether the buy may proceed. This process happens in a matter of seconds, focusing the speed and real-time character of charge card cost processing.

Safety is really a paramount problem in the region of financial transactions, and bank card payment processors are in the forefront of employing methods to safeguard sensitive and painful information. Sophisticated encryption technologies and conformity with market criteria make certain that customer information stays secure through the entire payment process. These protection methods not only safeguard people but additionally instill rely upon organizations adopting digital cost methods.

The credit card cost handling ecosystem is continuously changing, with processors establishing to technological advancements and adjusting client preferences. Cellular obligations, contactless transactions, and the integration of electronic wallets symbolize the lead of development in this domain. Charge card cost processors play an essential role in enabling firms to remain forward of those tendencies, giving the infrastructure required to support varied cost methods.

Beyond the standard brick-and-mortar retail room, bank card cost processors are crucial in powering the large landscape of e-commerce. With the rise of on line buying, processors help transactions in a digital setting, handling the particulars of card-not-present scenarios. The ability to easily navigate the complexities of electronic commerce underscores the adaptability and flexibility of credit card payment processors.

World wide commerce depends greatly on charge card payment processors to help transactions across borders. These processors handle currency conversions, address global conformity needs, and make certain that organizations can run on a worldwide scale. The interconnectedness of financial programs, supported by charge card payment processors, has transformed commerce into a truly borderless endeavor.

Charge card cost processors lead significantly to the development and sustainability of small businesses. By offering digital payment alternatives, these processors help smaller enterprises to develop their customer bottom and compete on a level playing subject with greater counterparts. The supply and affordability of credit card cost handling companies have become critical enablers for entrepreneurial ventures.

The landscape of bank card cost control also involves considerations of fraud elimination and regulatory compliance. Cost processors apply robust methods to detect and prevent fraudulent activities, protecting both organizations and consumers. Furthermore, keeping abreast of how to become a merchant processor -evolving regulatory needs assures that transactions stick to legitimate requirements, reinforcing the credibility and reliability of the cost control industry.

To conclude, charge card payment processors form the backbone of modern economic transactions, facilitating the easy movement of resources between corporations and consumers. Their multifaceted role encompasses rate, security, flexibility to technical shifts, and help for global commerce. As technology remains to improve and client choices evolve, charge card cost processors may stay key to the energetic landscape of electric transactions, surrounding the ongoing future of commerce worldwide.